This story is part of coverage for Gas Station Week, a tribute to unconventional beer spaces where craft beer has found a foothold. Read more stories from across the country.

THE GIST

While beer sales in most chain retail locations across the country have been stuck in neutral, convenience stores and gas stations offer breweries reason for optimism. In the first three months of 2023, convenience stores outperformed other types of outlets like supermarkets and liquor stores when it comes to how much beer is sold, a continuation of trends from last year.

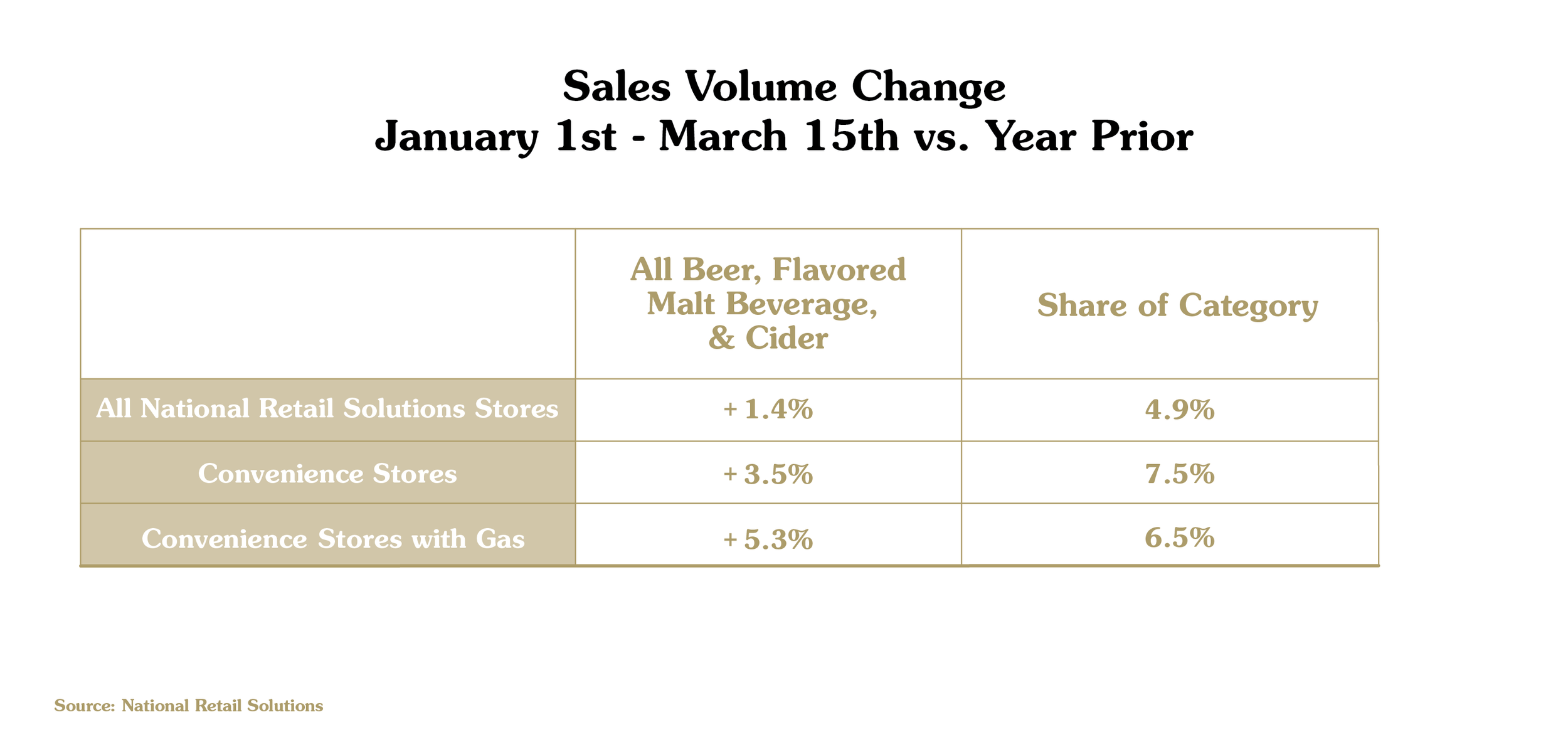

According to scan data from National Retail Solutions (NRS), collected from more than 20,000 independent stores operating its point of sale system:

Total beer volume—which includes flavored malt beverages (FMBs) and ciders—was up +5.3% in gas station stores Jan. 1 - March 15 when compared to the same time period last year.

That’s well above an increase of +1.4% for total beer across all stores in the NRS data set.

Craft beer has fared even better in gas stations stores, up nearly +9% in volume year-to-date, compared to being up +5% across all types of stores.

This swell in convenience and gas station sales benefits some brands more than others, but beers that debuted in convenience stores last year come from a range of brewery sizes. Leaders come from smaller producers (KettleHouse Brewing’s Fish On! Juicy Pale Ale and Mill River Brewing’s Hello My Name Is Beer Lager), regional companies (MadTree Brewing’s Tropical PsycHOPathy IPA and Odell Brewing Sippin’ Tropical Sour Ale), and the largest beer makers in the country (Samuel Adams’ Wicked Party IPA variety pack and Firestone Walker Brewing’s Hopnosis IPA).

With overall beer sales stalling and the craft segment facing its toughest sales challenges in years, retail locations once seen as home to only the biggest macro brands have become key outposts for companies seeking opportunities in a crowded market.

WHY IT MATTERS

Craft beer needs to reach new customers to reverse current trends and businesses have found gas stations and convenience stores to offer the white space the category desires.

Of 30,000 convenience stores who responded to Goldman Sachs analyst Bonnie Herzog’s most recent Beverage Bytes survey, 43% said they planned to expand shelf and cooler space for alcoholic beverages this year. This could benefit craft breweries in an ancillary way, but based on survey results, the biggest beneficiaries in the short term will be Constellation Brands’ imported Mexican beer portfolio (Modelo, Corona, Pacifico, etc.), and flavored malt beverages such as Boston Beer’s Twisted Tea, Monster Energy’s The Beast Unleashed, and Molson Coors’ Simply Spiked. Still, optimism is aplenty.

“Until we started selling beer in them, I was like, ‘Really? Craft beer from a convenience store?’ But I do get it now,’” says Dave Hertwig, co-founder and sales director at New Trail Brewing in Williamsport, Pennsylvania.

The brewery began selling in convenience stores in October 2020, and sales there almost immediately accounted for 5% of New Trail’s overall business. In the two and a half years since, that percentage has nearly doubled, and today about 9% of New Trail’s dollars come from that channel. Convenience stores have historically been the domain of the country’s biggest beer brands, and indeed, even among craft breweries, nationally available brands like New Belgium Brewing, Sierra Nevada Brewing, and Anheuser-Busch InBev-owned Goose Island Beer and Kona Brewing have historically dominated the channel.

“For so long, convenience stores were controlled by the macro beers, but we can play in that sandbox too,” Hertwig says. “It’s about meeting people where they’re making purchases.”

Increasingly, those food and beverage purchases are happening at gas stations. The 2023 NACS Convenience Industry Store Count found that 39 states and Washington D.C. saw an increase in the number of convenience stores opened in 2022 (79% of all convenience stores in the U.S. also sell gas). Meanwhile, the number of gas station kiosks—stations that don’t sell enough in-store products to be considered a convenience store—fell -49% since 2017, a decline that NACS attributes to shoppers looking for better food and beverage selections when they fuel up.

The growing number of gas station food stores, and the fact that 60% of them are independently owned, makes them a dynamic place for alcohol sales. This includes places like Sheetz, where a combined 140,000 square feet of its stores are dedicated to beer sales, from beer caves to coolers and warm shelves.

“‘Convenience store’ is a blanket term. You have one that couldn't sell craft beer if their life depended on it, and you have another that could be considered a craft beer bottle shop,” says Shane Douress, director of trade development for Aslin Beer Co. in Alexandria, Virginia. “Convenience stores have been stigmatized, but we want anybody to have access to our beer. … Yes, there are good, quality craft beer consumers in the c-store.”

Aslin is planning to launch 19.2oz cans this summer. It’s in anticipation of convenience stores and gas stations reorganizing their shelves a few months later during an annual process known as fall resets. That packaging size, plus 24oz cans, make up the vast majority of the single-serve beer market, which is the primary driver of beer sales growth in gas stations. Because they’re less expensive than a four- or six-pack and are designed for near-immediate consumption, these size cans fit the bill for shoppers grabbing a beer to drink soon after purchase.

“Single-serve is without a doubt where it’s at,” says Joe Sepka, co-founder of 3 Tier Beverages, a consulting and data analytics firm. “No other package format comes close to the +20% case volume growth we’ve seen from craft singles year-to-date.”

Sepka notes that four-packs are also a “bright spot” in the convenience channel, especially when they’re from local or regional craft breweries, though they make up a relatively small percentage of the overall packaging mix in those stores. Still, he says, they’re evidence that “nothing should be taken for granted or overlooked” when it comes to how dynamic convenience stores’ and gas stations’ beer sections are right now.

The need for craft breweries to grasp every opportunity is especially true as the category struggles in other outlets. Brewers Association chief economist Bart Watson anticipates negative craft brewery volume growth this year (if non-alcoholic beer brands are excluded), while draft beer sales still lag behind pre-pandemic levels.

Douress feels bullish about Aslin’s chances in gas stations. Building on years of sales growth in Virginia and Washington D.C. grocery stores, the brewery now feels it has wide enough brand recognition among shoppers—and compelling sales data to show convenience store owners—to make a bigger push into gas stations in Virginia and Pennsylvania. But Aslin will have one sizable hurdle to clear in those stores: Pricing.

“You wouldn't traditionally see a $20 four-pack of beer at c-store,” Douress says, though that is what Aslin’s four-packs of 16oz cans retail for in those stores.

Pricing is a double-edged sword when Aslin makes its pitch to gas station owners. On one hand, some balk at the brewery’s case prices, which are often $10 greater than other craft breweries. On the other hand, Aslin’s premium prices create larger customer “baskets,” something retailers are always striving for. And the styles that Aslin will sell in convenience stores—a Hazy IPA called Power Moves and a fruited sour called Volcano Sauce—are specialty styles that may induce less sticker shock among shoppers.

Shibli Haddad, owner of the Arroyo Shell station in Pasadena, California, says his store typically earns much more per can of craft beer than it does per can of macro beer. Inspired by his own interest in craft beer—and its higher price point—Haddad has turned his gas station into a beer shopping destination with sought-after brands like Bottle Logic Brewing, Humble Sea Brewing Co., Heater Allen Brewing, and Anchorage Brewing.

Beginning about five years ago, he slowly expanded his station’s beer section from five cooler doors of beer to 13, with just two of those reserved for macro beers like Budweiser, Coors, and Corona. (Today, those macro beers are mostly relegated to his store’s walk-in “beer cave.”) As his craft beer selection grew, he says, his revenue increased. At least some convenience store operators have seen the dividends that craft beer can bring to their registers.

“The growth of craft beer growth was insane, and I saw zero cannibalization of the macro beers. … Now you’re just generating extra revenue,” Haddad says, adding that he sells all his craft beers as single-serve cans or bottles, which increases margins. “You may not be selling $30,000 gross in craft beer every single month, but if you’re able to sell maybe $4,000 or $5,000 gross, that means net you’re walking away with an extra grand or two a month.”

Haddad says he’s tried to spread the dollars-and-cents wisdom of a vibrant craft beer selection to other convenience store and gas station owners. He advises them to start small by asking their existing distributor to order them a few of the top-selling local brands, and monitoring their increased revenue weeks and months down the road. The results won’t be instant, but he says it’s part of meeting consumers’ rising expectations of what convenience stores offer. To clear that increasingly high bar, Haddad spends thousands of dollars a year on art murals inside and outside the station, and creates custom playlists for the store based on customers’ and employees’ favorite songs. The station also has its own line of beers, made in collaboration with brewers who have flown to California for the project; these beers, brewed under the contract brewery name Replicant, are sold exclusively at Haddad’s store.

“With gas station owners, you want to do anything you can to get people in the door,” Haddad says. “If you have craft beer and the guy down the street doesn’t, the craft beer shopper is going to choose you.”