Craft beer sales are slowing. Breweries are closing. Even the equipment used to make beer is increasingly questionable. Despite an ongoing trickle of "The sky is falling!" moments in recent years, it's not that the industry is failing as much as it's evolving. Economies and drinkers change, and at this moment in time, new ways to approach the beverage and what it means to consumers are rapidly adjusting via new flavors, styles, and products.

Among those getting increased attention is beer that isn't really the "beer" we know. Whether it's because of changing attitudes toward consumption of alcohol or healthier lifestyles, non-alcoholic beer (NAB) is back in some kind of public spotlight, gaining attention in recent months from CNN, The Economist, VICE and more. The New York Times even covered the drink’s popularity with Olympic athletes.

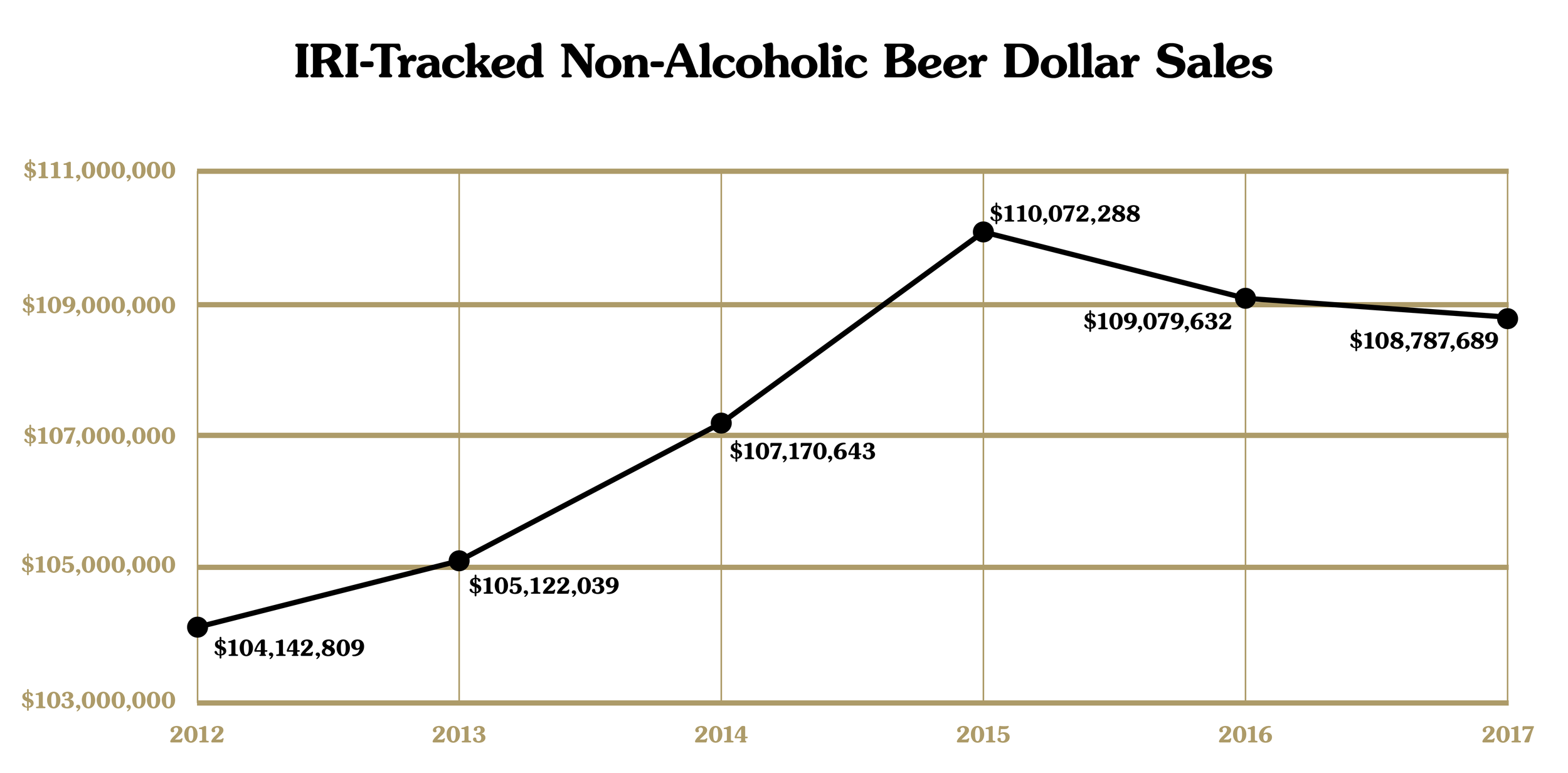

In 2017, 29 NAB brands tracked in IRI MULC stores (grocery, convenience, and others) accounted for nearly $109 million in sales, or roughly the same amount of Sierra Nevada Pale Ale sold in the those stores. Of the 29 NABs, 13 showed positive dollar sales gains between 2015 to 2017 and eight of 13 grew between 2016 and 2017.

This might not be a large category that beer enthusiasts care to track, but it's also nothing to ignore. What's more, it's seen as a sector that's ready for additional investment with NAB options seen as a new wave of drink choices for everyday consumers, not just people considering lifestyle or medical conditions. NABs represent less than a third of a percent of beer sales by volume in the U.S., so even fractional gains equal to millions of dollars.

“I honestly don’t think we’re going to replace beer,” says Jeff Stevens, co-founder of non-alcoholic beer producer WellBeing Brewing Company, which formed in 2017 and just recently began selling its products. “I think we’re going to get a lot of people who drink soda and sugary drinks. That’s where the market is because those can be the same occasions.”

Stevens, who spent a career in beer and spirits marketing, sees his new business as an opportunity for particular moments. Maybe a customer has had a couple beers and would be happy with the experience of a third, but not the alcohol. Maybe someone is looking for a drink more interesting than club soda. And maybe there are others like him, who don’t drink alcohol, and are tired of the rather staid NAB options long available.

“If we can articulate those moments, that’s where I think we can win,” he says.

Non-alcoholic brands aren’t pushovers, though. The most popular brand, O'Doul's, sold $36.5 million of beer in IRI MULC stores in 2017, a couple million more than Great Lakes Brewing Company’s entire portfolio. The second-most popular option, Busch NAB, amassed sales of $25.8 million, roughly the same amount of dollar sales in the MULC channel by Boulevard Brewing. In all, 12 different brands accrued more than $1 million in MULC sales last year, most of them being old standbys from years ago that aren’t similarly focused on the process or flavor of a company like WellBeing.

While still a nascent offering in modern craft beer context in the U.S., non-alcoholic beer has long had a place around the world. According to Euromonitor International, the global market for NAB grew 5% in 2016, the most recent year of data available. In fact, there’s so much potential for the category that Anheuser-Busch InBev believes NAB will make up 20% of its overall production volume by 2025. Carlsberg started its NAB brands in 2015 and expects those revenues to grow three times faster than its beer sales. Non-alcoholic versions of Budweiser and Corona were launched in 2016. Heineken 0.0 started sales in 2017. Open Gate Pure Brew, a 0.5% ABV Lager, was announced by Guinness in January.

These products wouldn’t exist unless the companies saw them as a viable option. Mintel reports a third of Spain and almost a quarter of Germany drink NAB “on occasion.” And as these things tend to do when the world’s biggest players are involved, there are more “craft” offerings popping up to provide a different kind of experience. In the UK, sales of low and non-alcoholic beer grew about 20% in 2017, opening up real possibilities for smaller producers. And as we’ll see in part two of this story, those possibilities are more adventurous than ever before.

—Bryan Roth